Table of contents

The financial landscape is evolving rapidly, with technology-driven solutions leading the charge towards a more efficient and inclusive ecosystem. One pivotal element in this transformation is the Electronic Money Institution (EMI) license, which unlocks a host of capabilities for financial businesses. This exploration delves into the multitude of advantages that such a license offers, illuminating the pathways to enhanced operational prowess and market competitiveness. Discover the strategic edge that obtaining an EMI license can confer upon your financial enterprise.

Understanding the EMI License

An Electronic Money Institution (EMI) license is a certification that allows businesses to offer a variety of financial services associated with electronic money. Operating under stringent EMI regulations, this license signifies adherence to a regulatory framework designed to maintain financial stability, protect consumers, and ensure the integrity of financial markets. The services an EMI licensee can offer include issuing and handling electronic money, facilitating payments, and undertaking money remittance services. To obtain an EMI license, a business must navigate the license application process, which typically involves demonstrating robust operational procedures, sound financial health, and strict compliance requirements. The financial regulatory authority in each jurisdiction oversees the issuance and regulation of EMI licenses, ensuring that licensees operate within the prescribed legal and financial boundaries.

The Gateway to Expanded Services

For financial businesses seeking to enhance their market reach and service offerings, securing an EMI license in Europe serves as a transformative step. With this accreditation, a company gains the authority to issue electronic money, which is a pivotal service in today’s digital economy. This capability extends far beyond traditional banking, allowing for the provision of innovative payment services that cater to the evolving needs of consumers and businesses alike. Facilitating transactions across borders and currencies, an EMI license underpins a business’s ability to deliver a more diverse suite of financial products.

The allure of an EMI license lies not only in the capacity for electronic money issuance but also in the potential for service diversification. With this license, a company can introduce novel financial innovation into its operations, thereby boosting customer acquisition. In a competitive financial landscape, the ability to offer cutting-edge payment solutions can be a game-changer, drawing in a larger and more varied customer base. A financial business equipped with an EMI license can redefine its position in the market, ensuring it stays ahead of the curve in a rapidly changing financial sector.

Boosting Customer Trust and Credibility

In the competitive landscape of financial services, consumer trust and industry credibility are paramount for the success of any business. An Electronic Money Institution (EMI) license greatly enhances a financial business's standing by underscoring its commitment to regulatory compliance and financial oversight. Holding an EMI license is akin to wearing a badge of legitimacy; it assures customers that the institution adheres to stringent prudential regulations, designed to ensure financial stability and reliability. This adherence to high standards can be a determining factor for customers when they choose their financial service provider. In essence, the presence of an EMI license signals to customers and peers alike that the institution is trustworthy and operates within the bounds of financial regulations, which is instrumental in building long-term business relationships based on confidence and security.

Operational Efficiency and Risk Management

Acquiring an EMI license goes far beyond mere regulatory compliance; it paves the way for enhanced operational efficiency and robust risk management. A licensed Electronic Money Institution must integrate advanced risk management systems, ensuring secure operations that stand up to the dynamic nature of financial threats. Such systems are not just about adherence to regulatory norms but are the bedrock of a resilient business model that can anticipate and mitigate potential threats to both the business and its clients.

These comprehensive risk management processes often lead to significant cost savings. By preemptively identifying and addressing vulnerabilities, businesses can avoid the high costs associated with financial fraud, data breaches, and operational downtime. In an environment where efficiency equates to competitiveness, the savings realized from strong risk management practices can be repurposed into innovation or customer service enhancements.

Consistent with the requirements of an EMI license, institutions must adhere to stringent anti-money laundering (AML) measures. These measures are instrumental in combating financial crime and preserving the integrity of the financial system. The AML framework, while complex, is instrumental in ensuring reliable service delivery and maintaining customer trust. Implementing such demanding AML protocols exemplifies the high standard of security and due diligence expected of licensed EMIs, which, in turn, reinforces their reputation in the marketplace.

Strategic Partnerships and Market Expansion

Obtaining an EMI (Electronic Money Institution) license unlocks a plethora of opportunities for financial businesses, particularly in forging strategic partnerships and propelling market expansion. With this license, a company can seamlessly collaborate with banks, merchants, and a variety of financial institutions, creating a robust network that is instrumental for accelerated growth and market penetration. This ecosystem collaboration is especially beneficial for those looking to make their mark on an international scale. An EMI license serves as a gateway to international expansion, allowing businesses to manage and offer multi-currency offerings with greater ease. It also facilitates efficient cross-border payments, highlighting a company's capability to handle global transactions and adapt to the diverse financial needs of clients across different regions. By leveraging these strategic partnerships and expanding into new markets, businesses with an EMI license can achieve a competitive edge and foster long-term sustainability in the complex world of finance.

Similar

How Specialized Agencies Enhance Medical Presentation Impact

Exploring the Unique Investment Opportunity of Wynwood Horizon in Dubai

How Modern Workspaces Boost Productivity And Community?

Exploring The Rise Of Flexible Workspaces In Modern Cities

How Affordable Backlink Services Boost SEO Without Breaking The Bank

The Ultimate Guide To Simplifying Live Shopping Logistics

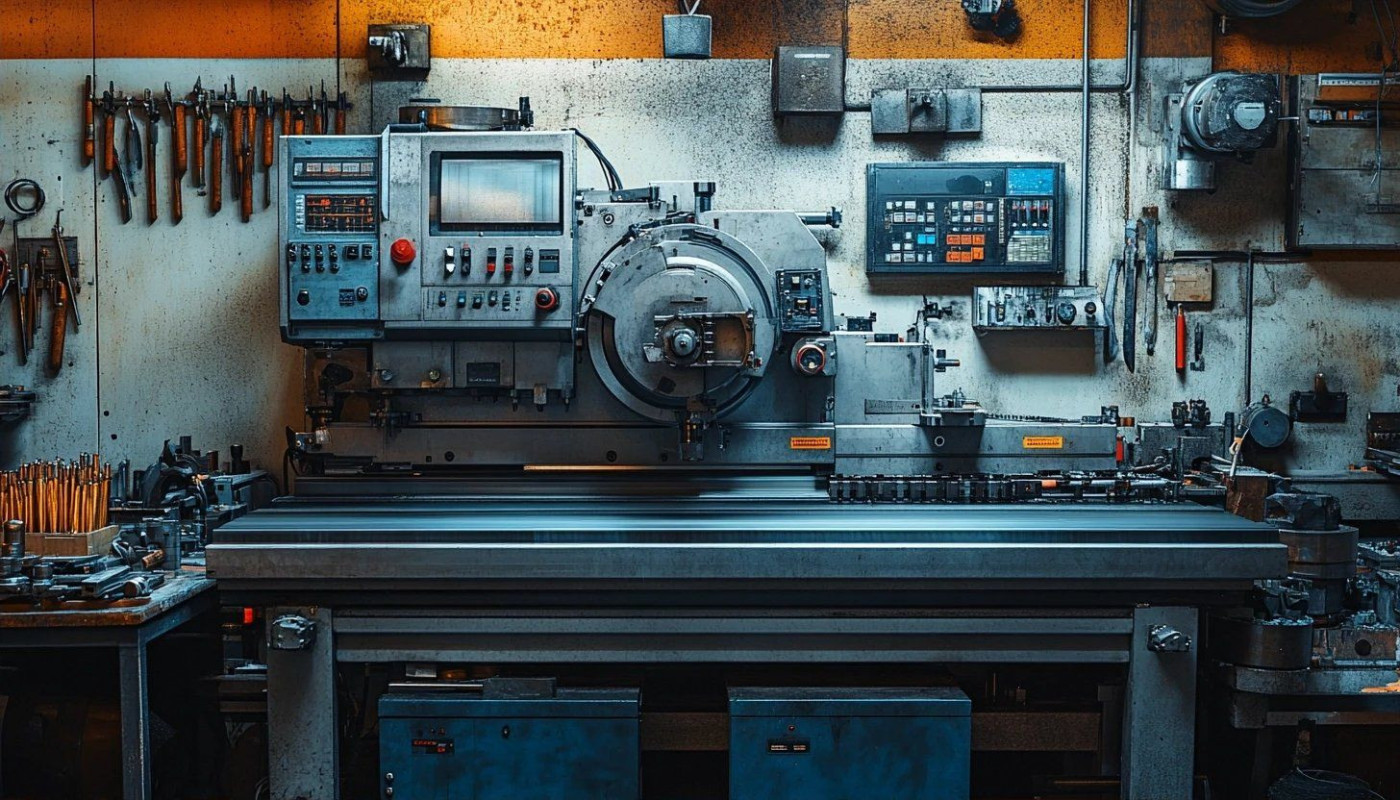

How To Choose The Right Used CNC Lathe For Your Manufacturing Needs?

Exploring the potential of green energy solutions for sustainable small business growth

Utilizing data-driven decision making to propel business success

How Multi-site Platforms Streamline Global Brand Management

Exploring the subscription box craze - how to start a subscription service with low overhead

How To Optimize Team Workflow With Project Management Tools

How Generative AI Is Revolutionizing Creative Industries

Exploring The ROI Of Deploying Chatbots Across Different Business Sizes

How To Efficiently Obtain A French Company's Certificate Of Incorporation

How Personalized Onboarding Boosts Product Engagement And Retention

The Impact Of Cultural Differences On Outsourcing: Navigating Challenges For Global Business Success

The Impact Of Virtual Reality On The Sports Industry's Business Models

How Omnichannel Cloud Solutions Are Revolutionizing Customer Service Efficiency

The Impact Of E-commerce On Local Businesses

Using an e-mail checker : why is this practice so important ?